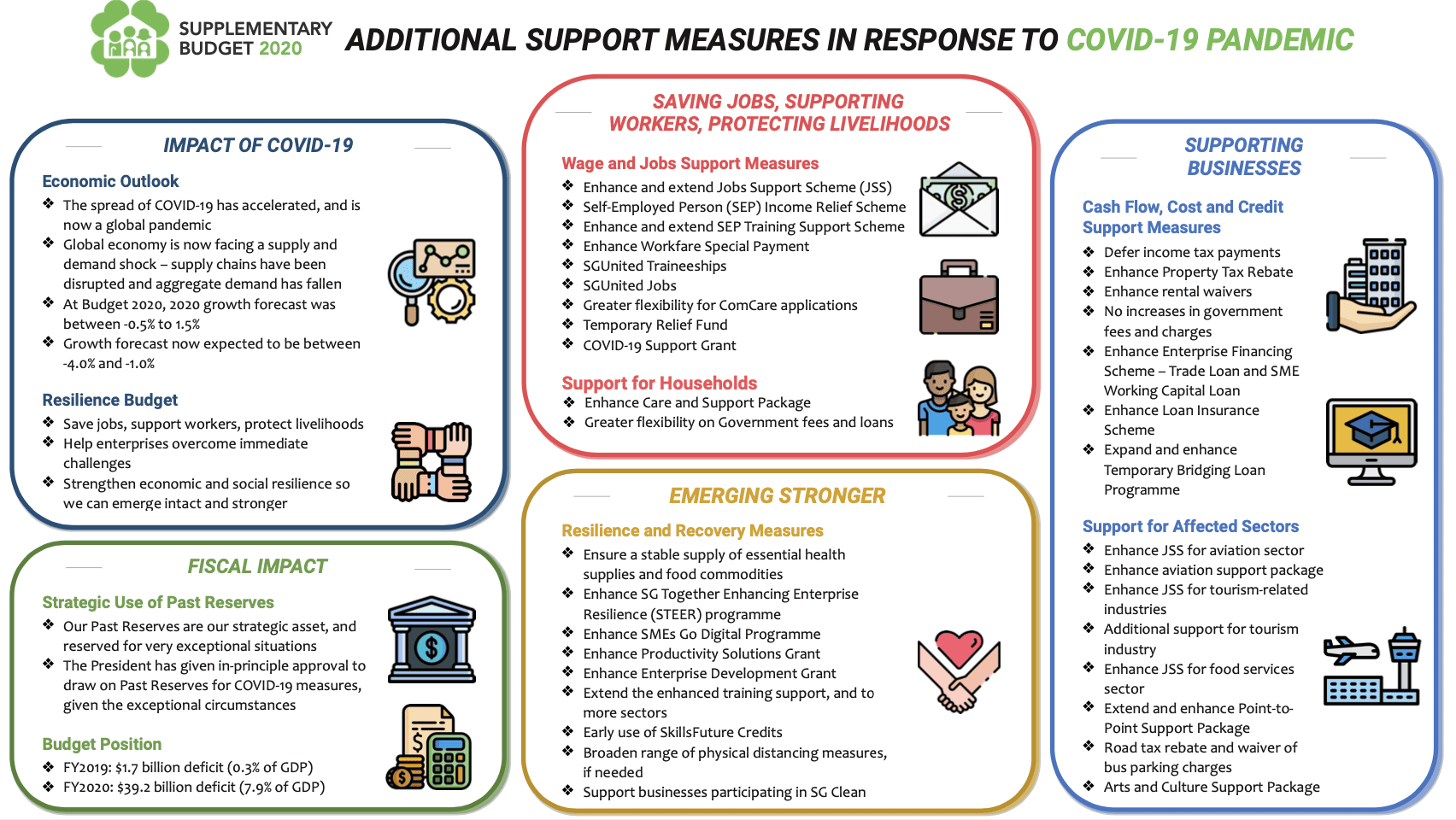

Marked by major financial uncertainties and tectonic shifts in the SME operating environment due to the Covid-19 pandemic, this year’s Singapore Budget 2020 primarily focused on current concerns over businesses and jobs.

Hence, a collection of initiatives were announced to help business owners in Singapore overcome near-term challenges as well as to help them strengthen business capabilities for the future.

From receiving more aid to entering new markets to innovating and adopting digital solutions through financial support packages, here are key points we rounded up from the speech.

Infographic Courtesy of Singapore Budget

Enterprise Financing Scheme (EFS)

Administered by Enterprise Singapore, the Enterprise Financing Scheme (EFS) provides targeted financing to better support Singapore SMEs throughout their various phases of growth. Supported by various participating financial institutions (PFIs), some of the financing schemes available are:

- SME Working Capital Loan – Created to finance day-to-day general cash flow requirements. Following the Solidarity Budget Announcement, for new applications initiated from 8 April 2020 until 31 March 2021, the maximum loan amount will be increased from S$300,000 to S$1 million. The government risk share percentage is also increased to 90% from 50-70%.

- The Temporary Bridging Loan Programme (TBLP) – Provides access to working capital for business needs. Announced at the Solidarity Budget 2020, eligible enterprises may borrow up to S$5 million, with the interest rate capped at 5% p.a., from Participating Financial Institutions (PFIs). The Government will also provide 90% risk-share on these loans for new applications initiated from 8 April 2020 until 31 March 2021.

- Trade Loan – Works as fully revolving credit facilities, which help fund a business between the time it has to pay for the purchased goods, and the time when the firm receives the funds from the sale of those goods. As per the Solidarity Budget 2020 announcement, the maximum loan quantum for Trade Loan is increased from S$5 million to S$10 million. The government risk-share percentage is also increased to 90% for new applications that are initiated from 8 April 2020 until 31 March 2021.

Enterprise Grow Package

To help new and established SMEs identify business needs, adopt pre-approved digital technologies and take the first steps to enter new markets, the Enterprise Grow Package was introduced.

The SMEs Go Digital programme will be expanded and will grant enterprises pre-approved access to digital solutions across 23 vibrant industry sectors. A new platform, GoBusiness, was also created to access streamlined license applications and transact more easily with the Government.

Enterprise Leadership for Transformation Programme

The Enterprise Leadership for Transformation (ELT), a one year programme, was created to support business leaders of promising SMEs to develop their business growth capabilities. . Eligible enterprises can also qualify for up to 90% funding of programme fees.

In tandem, the Enterprise Development Grant, which provides integrated support for enterprises to innovate, will also expand its reach. The grant funds qualifying project costs like third party consultancy fees, software and equipment as well as internal manpower costs and the maximum support level will be raised to 80% from 1 April 2020 to 31 December 2020. Depending on the extent of impact that Covid-19 has brought about for the business, support levels may be raised to 90% at maximum(cases will be reviewed individually).

Care and Support Package

All Singaporean employees and self-employed persons who received Workfare Income Supplement (WIS) payments in Work Year 2019 will receive a Workfare Special Payment (WSP) in 2020. As per the Singapore Budget 2020, the Care and Support Package is enhanced to provide a cash payout of S$3,000 (which will be paid over two equal payments of S$1,500 each, in July and October 2020), up from the quantum announced previously. The enhanced WSP will also provide additional support for low-wage workers aged 35 and above in 2019.

Jobs Support Scheme (JSS)

The Job Support Scheme was enhanced to cover 75% of all local employees’ wages in April, up to the salary ceiling of S$4,600, as part of Supplementary Budget measures to save Singapore firms and jobs amid the Covid-19 pandemic. The salary support is also scaled to 25% for the next eight months, with higher subsidies of 50% for those in food services and 75% for those in the tourism and aviation industry.

Expanded Productivity Solutions Grant (PSG)

Offering support for sector-specific solutions, the PSG covers industries like landscaping, construction, precision engineering, logistics, food, and retail. If your SME does not fall in any of the industries, there are technological solutions that cut across these industries – such as inventory tracking, financial management, data analytics, digital customer relationship management and human resource management systems.

From 1 Apr 2020 to 31 Dec 2020, the maximum support level for PSG will be raised to 80% and businesses will receive more co-funding support for digitalisation. The expanded suite of PSG-supported solutions will now cover:

- Online collaboration tools

- Virtual meeting and telephony tools

- Queue management systems, and

- Temperature screening solutions

TL;DR:

Unity Budget (Announced on 18 Feb 2020)

- Wage support from Jobs Support Scheme

- All Singaporeans aged 25 and above are eligible for S$500 SkillsFuture Credit top-up

- To help companies retain senior workers, a Senior Worker Support Package has been introduced.

- To support re-skilling initiatives for those in their 40s and 50s, the SkillsFuture Mid-Career Support Package has been introduced.

Resilience Budget (Announced on 26 Mar 2020)

- To provide enhanced wage support for those in sectors most affected by COVID-19, enhancements to the Jobs Support Scheme have been made.

- For eligible SEPs, a monthly cash payout will be initiated via the Self-Employed Person Income Relief Scheme (SIRS).

- To help SEPs train and upskill, the Self-Employed Persons Training Support scheme has been introduced.

- A one-off cash payment of S$3,000 will be made under the Enhanced Workfare Special Payment.

- For lower and middle-income workers who lost their jobs, a COVID-19 Support Grant has been introduced.

- For families who need urgent help, a Temporary Relief Fund has been organised.

- An SGUnited Jobs initiative has been introduced to create 10,000 jobs

- For first-time jobseekers, SGUnited Traineeships will be organised to support 8,000 traineeships

Solidarity Budget (Announced on 6 Apr 2020)

- 75% of the first S$4,600 of monthly salaries of April 2020 for all local employees will be paid out by the Government

- 1st JSS payout will be brought forward from May to April 2020

- Wage subsidy levels will revert to what was announced in Resilience Budget from May 2020

- A total of estimated 100,000 SEPs will qualify for the SEP Income Relief Scheme (SIRS)

- Starting from May 2020, SEPs will receive three quarterly cash payouts of S$3000 each.

For a more detailed look at the Singapore Budget 2020 announcement, you can visit the Singapore Ministry of Finance’s official Budget website, here.

As your business deals with new challenges and complexities due to Covid-19, how can you stay nimble and embrace transformation to take advantage of emerging growth opportunities?

That’s where we come in! If you’re looking for digital solutions to raise the operational efficiency and productivity of your Singapore business, you’d be happy to know that we’re an IMDA-approved digital creative agency ourselves and we’re definitely confident in supporting your business needs for the best value at a subsidised rate. Simply drop us a message and we can have a chat!